🚨 BREAKING: Netflix’s BOMBSHELL Legal Letter Just JEOPARDIZED Gaming’s BIGGEST Sequel EVER! ⚡😱

$83B mega-deal EXPLODING in lawsuits & Congress pleas—rival giants SUING to KILL it DEAD! 🔥

Devs FREAKING OUT as wizard epic’s future Hangs by a THREAD… Netflix takeover = GAME OVER? 🤯

The DRAMA will SHOCK you—tap NOW before it’s CANCELED! 👇

Warner Bros. Discovery’s blockbuster $82.7 billion sale of its studios and streaming assets to Netflix—encompassing WB Games and HBO—faced a double-barreled assault this week from jilted bidder Paramount Skydance. A fresh lawsuit in Delaware court demands confidential details of the Netflix pact, while Paramount’s top lawyer lobbied Congress to deem the merger “presumptively unlawful.” The escalating corporate showdown, unfolding amid a January 21 tender offer deadline, spells potential delays for high-stakes projects like the anticipated Hogwarts Legacy 2, whose storyline is intertwined with HBO’s rebooted Harry Potter TV series.

Announced December 5, 2025, the Netflix transaction values WBD’s film, TV, and streaming divisions—including hits like Harry Potter, DC Comics, and Game of Thrones—at $27.75 per share in cash and stock. Shareholders stand to pocket $23.25 cash plus Netflix shares worth $4.50 apiece. The deal, post-separation of WBD’s cable arm Discovery Global, eyes a mid-2027 close, pending regulatory nods. Netflix, eyeing a gaming empire boost via studios like Avalanche Software (Hogwarts Legacy) and NetherRealm (Mortal Kombat), dismissed gaming assets as “relatively minor” in its bid calculus.

The Frenzied Bidding War

WBD’s October 2025 fire sale ignited a frenzy after years of debt woes and streaming wars. Netflix emerged victorious, but Paramount Skydance—backed by Oracle co-founder Larry Ellison, father of CEO David Ellison—lodged aggressive counteroffers. Here’s a side-by-side:

Bidder

Offer Value

Structure

Coverage

Status

Netflix

$82.7B

Cash + Stock ($27.75/share)

Studios/Streaming only

Accepted; tender Jan 21

Paramount Skydance

$108.7B

All-Cash ($30/share)

Entire WBD (incl. cable)

Rejected 8x; sued for info

Paramount claims its bid trumps Netflix’s by avoiding a “worthless” cable spinoff and clearing antitrust faster. WBD fired back, labeling Paramount’s overtures “deficient” and the suit “meritless.”

Lawsuit and Proxy Gambit

Filed January 12, 2026, in Delaware Chancery Court, Paramount’s complaint targets WBD, CEO David Zaslav, and investor John Malone. It demands the board’s financial models valuing the Netflix deal, arguing opacity shields a inferior transaction. Paramount also eyes a proxy fight: nominating directors to torpedo Netflix approval and amend bylaws mandating shareholder votes on asset splits.

“Time is of the essence,” the suit warns, with the tender expiry looming. Walking from Netflix triggers a $2.8 billion breakup fee—part of $4.7 billion in penalties. Analyst Craig Huber shrugged: “Raise the bid. Money talks.”

Antitrust Alarm to Congress

Compounding the pressure, Paramount Chief Legal Officer Makan Delrahim—ex-Trump DOJ antitrust head—penned a letter to the House Judiciary Committee’s antitrust subcommittee. He branded the merger “presumptively unlawful,” warning it would “cement Netflix’s dominance in streaming video on demand.” The missive, filed last week, urges scrutiny amid Netflix’s 40%+ U.S. market share.

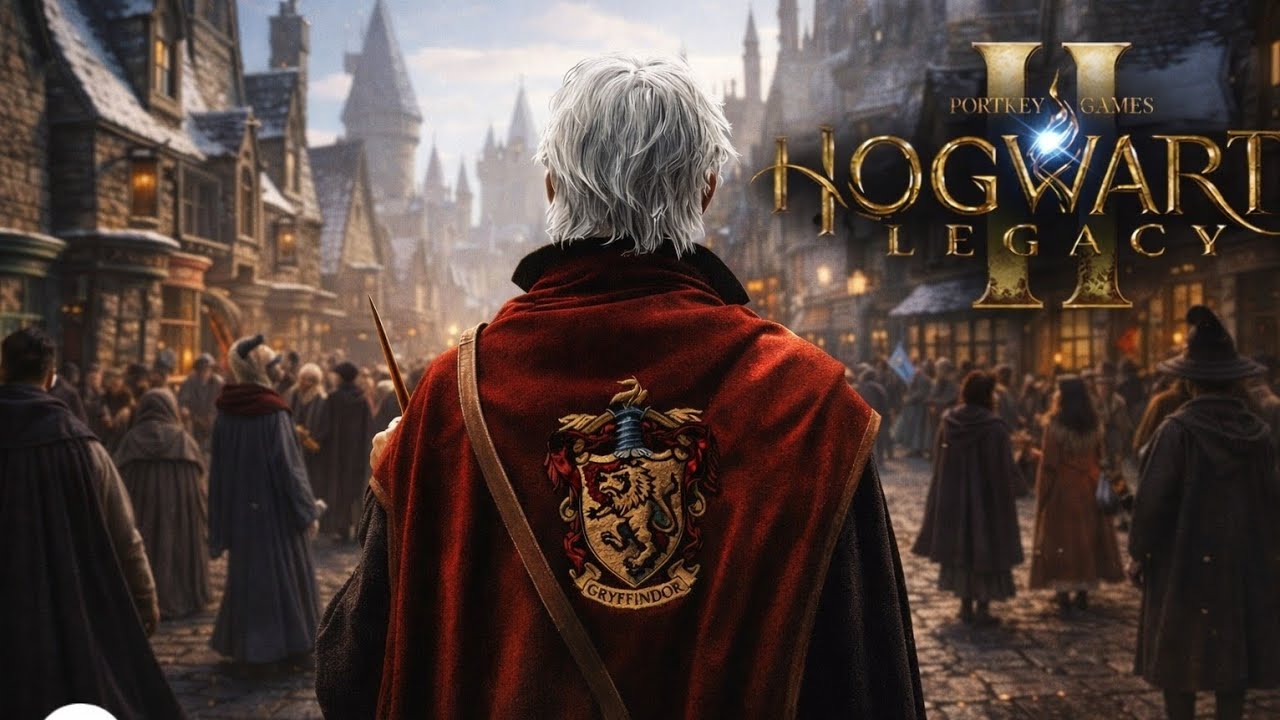

Hogwarts Legacy 2: Magic Meets Merger Mayhem

At stake: Hogwarts Legacy 2, sequel to the 40-million-unit juggernaut that grossed over $1 billion. Developed by Avalanche under WB Games president David Haddad (now departed), it’s in early stages, eyeing a post-2026 launch—possibly 2028.

Crucially, Haddad revealed in a 2024 Variety interview: HL2’s narrative syncs with HBO’s Harry Potter reboot, penned by Francesca Gardiner for Max (HBO’s streamer). Season 1 events feed directly into the game’s plot, a rare cross-media synergy. Both are “too far into development” for outright cancellation, but delays could scramble scripts—especially if HBO’s premiere precedes the merger.

Netflix’s gaming ambitions—bolstered by the deal’s NetherRealm, Rocksteady, and Player First—raise eyebrows. Critics fear a live-service pivot or cuts, echoing Netflix’s spotty studio track record.

Social Media Storm and Fan Fears

X lit up with panic. “Legal snag for Hogwarts Legacy 2: Paramount sued… battle could delay or reshape tie-ins,” posted @playswave_com, garnering 158 views. @PCGamesPlay1 warned of a “legal spell” brewing storms. Reddit frets over post-merger fates, with users eyeing 2026+ timelines.

Broader Stakes for Hollywood and Gaming

WBD’s trove—Harry Potter film/game rights (books aside), DC, LOTR—fuels the frenzy. Paramount’s all-cash pitch promises stability; Netflix offers streaming synergy but regulatory heat. A prolonged fight risks talent exodus and project stalls.

WBD insists the Netflix path maximizes value; Paramount cries foul. As tender shares trickle in, eyes turn to Delaware docket and Capitol Hill.

For Hogwarts Legacy faithful, the saga underscores IP’s high-wire act. Patches won’t fix a derailed merger—but 40 million sales buy goodwill. Will lawyers or wizards prevail? The cauldron bubbles.